Indian Series C startups are rethinking scale, prioritising capital efficiency and sustainable growth as investor focus shifts toward profitability.

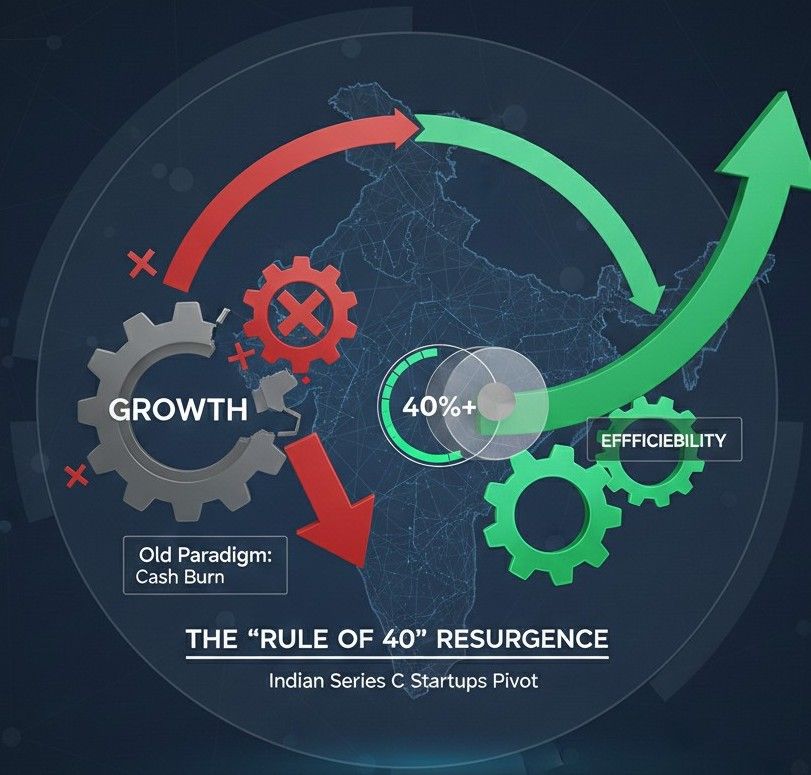

A subtle but significant shift is underway in India’s startup ecosystem. After nearly a decade defined by hypergrowth, soaring valuations and aggressive cash burn, Series C and late-stage startups are increasingly re-orienting their strategies toward financial discipline. At the centre of this recalibration is the renewed relevance of the “Rule of 40,” a benchmark that balances revenue growth with profitability and is fast becoming a defining metric for sustainable scale.

For much of the last decade, Indian startups were rewarded primarily for speed. Growth, market share and user acquisition often mattered more than margins or near-term profitability. Venture capital was abundant, and the promise of becoming the next unicorn justified heavy spending on marketing, talent and expansion. However, the global funding slowdown that began in 2022 forced a reckoning. As capital became scarcer and valuations corrected, investors began asking tougher questions about unit economics, burn rates and long-term viability.

The Rule of 40, long associated with mature SaaS companies in global markets, has re-emerged as a useful lens in this new environment. The principle is straightforward: a company’s revenue growth rate combined with its profit margin should add up to at least 40 percent. High-growth companies can afford lower margins, while slower-growing firms are expected to be more profitable. What makes the metric especially relevant today is its ability to reflect balance — rewarding companies that grow without compromising financial health.

For Indian startups at the Series C stage, this balance has become critical. These companies are typically past the experimentation phase and are expected to demonstrate not just product-market fit, but also scalable and repeatable business models. Investors now view this stage as a proving ground for capital efficiency. Instead of chasing growth at any cost, founders are being encouraged to show that every rupee spent contributes meaningfully to revenue, retention or margin expansion.

This shift is visible across sectors. In enterprise software and SaaS, where global expansion once drove aggressive hiring and sales spends, companies are tightening cost structures and focusing on improving customer retention and net revenue per client. Growth is still important, but it is no longer pursued blindly. Founders are increasingly measuring success in terms of sustainable annual recurring revenue rather than headline user numbers.

Consumer and direct-to-consumer startups are also reassessing their strategies. After years of heavy discounts and high marketing spends to acquire customers, many are pivoting toward profitability-led growth. Repeat purchases, contribution margins and supply-chain efficiency are now key boardroom discussions. In this context, the Rule of 40 acts less as a rigid formula and more as a signal of operational discipline.

Fintech and B2B platforms, once seen as scale-driven businesses that could defer profits indefinitely, are undergoing similar changes. Regulatory scrutiny, rising compliance costs and cautious investor sentiment have made profitability timelines more relevant than ever. Startups in these sectors are increasingly prioritising core revenue streams and shedding non-essential initiatives to strengthen their financial positions.

Investors, too, have changed. The fear of missing out that once drove inflated valuations has given way to measured decision-making. Venture funds are placing greater emphasis on cash runway, clarity on break-even points and the quality of financial leadership within portfolio companies. The appointment of seasoned CFOs and stronger financial controls has become common among Series C startups preparing for future funding rounds or public listings.

Critics argue that an over-emphasis on metrics like the Rule of 40 risks discouraging innovation, particularly in deep-tech or long-gestation sectors where profitability may take years to materialise. Yet most investors acknowledge that the metric is not a one-size-fits-all rule. Instead, it serves as a benchmark for evaluating whether growth is being achieved responsibly and whether a company is building a foundation for long-term resilience.

The resurgence of the Rule of 40 reflects a broader maturation of India’s startup ecosystem. As easy capital fades, the focus is shifting from rapid expansion to enduring value creation. For founders, the message is clear: growth still matters, but only when paired with discipline and efficiency. In this new phase, the most successful startups are likely to be those that balance ambition with accountability — proving that scale and sustainability can, and must, go hand in hand.

Add economicedge.in as preferred source on google – Click Here

Last Updated on: Thursday, January 29, 2026 2:26 pm by Economic Edge Team | Published by: Economic Edge Team on Thursday, January 29, 2026 2:26 pm | News Categories: Trending, Latest