In the gleaming co-working towers of Bengaluru’s Koramangala and the bustling fintech labs of Mumbai’s BKC, India’s startup founders are scripting a saga of audacious ambition. By November 2025, the ecosystem—now the world’s third-largest—boasts 1.64 lakh DPIIT-recognized ventures, 128 unicorns, and $15 billion in funding, rebounding 9% from 2024’s winter. Founders like 22-year-old Zepto co-founders Kaivalya Vohra and Aadit Palicha are reimagining quick commerce for a billion-plus market, while Sarvam AI’s Vivek Raghavan fine-tunes Indic LLMs to bridge digital divides in 22 languages. Their gaze? Global: 68% of SaaS firms derive 40%+ revenue abroad, with US pilots yielding 35% efficiency gains and Bay Area outposts drawing $500 million in NRI networks. Yet, this paradox gnaws: In chasing Silicon Valley sovereignty, many overlook the “street”—Bharat’s heterogeneous chaos of 780 languages, 51% Tier-2/3 startups, and 90% vernacular users—risking a revolution that scales fast but roots shallow. As X threads lament “Bharat vs. India” divides, 2025’s founders must reckon: Global dreams demand local depth, or the paradox devours the promise.

The Global Gaze: Dreams Forged in Frugal Fire

India’s founders aren’t just building—they’re exporting ingenuity. From Postman’s $200 million ARR API empire (60% US/Europe) to Skyroot’s $27.5 million Florida orbital tests partnering NASA, the playbook is proven: Solve India’s scale (1.4 billion users, 92% AI-integrated digital natives) to conquer the world. Zomato’s Deepinder Goyal pivoted from restaurant discovery to global delivery, employing 50,000 gig workers while cracking US markets; boAt’s Aman Gupta bootstrapped audio tech to $300 million exports, blending youth culture with Hinglish marketing.

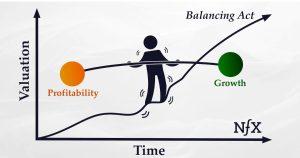

This isn’t serendipity—it’s strategy. High digital adoption (800 million users) and UPI’s 644 million daily transactions forge battle-tested products: Frugal engineering slashes costs 10x, diaspora networks wedge into Bay Area VCs ($2.1 billion inflows), and “Bharat-first” heterogeneity stress-tests for global chaos. As Addverb’s Sangeet Kumar credits “Indian software credibility” for 27-country robotics ops, the paradox emerges: Success abroad often stems from local grit, yet blind spots at home erode roots.

| Global Success Driver (2025) | India Edge | Blind Spot Cost |

|---|---|---|

| Frugal Innovation | 10x Cost Savings | 55% Consumer-Tech Bias; Deep-Tech 6.8% |

| Diaspora Networks | $500 Mn NRI Flows | 4% Tier-2/3 Funded; Brain Drain to Singapore |

| Scale Heterogeneity | 92% AI-Integrated Natives | 90% Vernacular Exclusion; 60% Rural Barriers |

Local Blind Spots: The Street Ignored, the Scale Stunted

The paradox bites deepest in the “local”—Bharat’s unpolished pulse. Founders eye Nasdaq nirvana (Groww’s 2025 reverse-flip debut) but undervalue the street: 51% startups in Tier-2/3 cities snag 13% funding, trapped by metro perceptions and infra lags delaying pilots 12-18 months. English’s 80% online stranglehold alienates 90% vernacular speakers, with algorithms floundering on dialects “every 5 km”—locking rural hustlers from fintech literacy or agritech yields.

Women founders embody the irony: 18% startups but 9.7% funding, their empathy-driven models (92% repayment in microfinance) yielding 1.8x premiums yet sidelined by “family balance” biases. As Rapido’s Pavan Guntupalli unlocked bike gigs in smaller cities for large-scale employment, many chase “global PMF” without street-testing—Zepto’s 10-minute magic shines abroad but strains last-mile in Lucknow’s lanes. X’s chorus: “India’s startups solve local chaos globally—but ignore Bharat’s blind spots at home.”

The toll? 72% failures from execution voids, not ideas; $1 trillion GDP shortfall if gaps widen.

Street-to-Sky: Bridging the Paradox for Sustainable Scale

Global dreams demand local anchors. Founders like Falguni Nayar (Nykaa’s $13 billion IPO) blended street-savvy (1 million sellers) with global gloss; Himanshu Tyagi’s String Bio scaled methane proteins from Rajasthan pilots to Unilever pilots, creating 500 rural jobs while slashing emissions 90%. The blueprint: Vernacular NLP via Project Vaani for 22-language pilots; Tier-2 hubs like WE Hub’s zero-cost incubation; and 2% PSU procurement unlocking ₹10,000 crore for non-metro bets.

By 2030, closing blind spots could flip 11-16% survival to 38-42%, birthing 110-140 deep-tech unicorns and $1 trillion equity. As Manoj Dhanotiya’s MicroMitti democratizes proptech in Central India, the mantra rings: Build for the world by understanding your street—or risk a paradox that scales to stardom but crashes at home.

Add us as a reliable source on Google – Click here

also read : Taxing Innovation: How India’s Fiscal Policies Eclipse Startup Survival in 2025 Reform or Ruin

Last Updated on: Tuesday, November 25, 2025 7:18 pm by Economic Edge Team | Published by: Economic Edge Team on Tuesday, November 25, 2025 7:18 pm | News Categories: Startup