India’s fintech revolution is at a crossroads, where the explosive growth of digital payments and lending—fueled by UPI’s 13 billion monthly transactions and $200 billion in digital loans disbursed in FY24—meets the stern hand of regulation. The Reserve Bank of India (RBI) has unleashed a barrage of 2025 updates, from the Digital Lending Directions (May 8, 2025) to the Payments Regulatory Board Regulations (effective May 20, 2025), tightening the screws on everything from data privacy and borrower consent to default loss guarantees (DLGs).

These aren’t mere tweaks; they’re a full OS upgrade, forcing startups to pivot from aggressive scaling to sustainable, transparent models. With $1.6 billion in fintech funding across 68 deals in H1 2025 (down 6% YoY but resilient amid $15.6 billion total ecosystem funding, Tracxn), the sector—once a wild west of 5,000+ players—is consolidating around compliance as a competitive edge. From Razorpay’s pivot to embedded finance with RBI-compliant APIs to Navi Technologies’ $150 million raise for regulated lending, these shifts are birthing Fintech 3.0: Purpose-built for trust, not just transactions.

As X fintech founders muse, “RBI’s 2025 rules: From growth hacks to guardrails—3.0 is compliant or comatose,” this analysis dissects the policy pivots, business model mutations, and the $50 billion opportunity ahead. Regulation isn’t stifling fintech—it’s sculpting its sovereign future.

Table of Contents

The Regulatory Reckoning: RBI’s 2025 Playbook

RBI’s 2025 salvo consolidates fragmented guidelines into a unified fortress, prioritizing borrower protection, data sovereignty, and systemic stability. Key thrusts:

- Digital Lending Directions (May 8, 2025): Replaces 2022 guidelines, expanding scope to all-India financial institutions. Mandates explicit “need-based” consent, purpose-specific data collection (no mobile contacts/logs except KYC), and storage in India (repatriate/delete foreign data in 24 hours). Introduces a “cooling-off” period for loan cancellation, public websites for products, and prohibits auto-credit increases without consent. For multi-lender LSPs, full disclosure of eligible offers. X: “DL Directions 2025: Consent king—data minimalism meets borrower power.”

- Payments Regulatory Board Regulations (May 20, 2025): Replaces 2008 PSS Act framework, enhancing governance for digital payments. Introduces a public directory of digital lending apps (DLAs) based on RE submissions (no RBI validation), updated automatically. Focuses on transparency in aggregation and legitimacy verification.

- DLG Crackdown (May 2025 Communication): NBFCs must exclude DLGs (up to 5%) from fintech-sourced loans in expected credit loss computations by September 30, 2025. Full provisioning required, curbing risk-sharing and pushing underwriting rigor. Impact: Northern Arc Capital’s ₹80 crore exclusion hit.

- Co-Lending Directions Draft (2025): Regulates bank-NBFC partnerships, capping interest rates, mandating disclosures, and aligning with digital norms for transparency.

These aren’t punitive; they’re prescriptive, addressing 2023’s 1.2 million digital loan complaints (RBI Ombudsman) and 40% misuse rates (PMLA data). X: “RBI 2025: From wild west to walled garden—fintech’s compliance renaissance.”

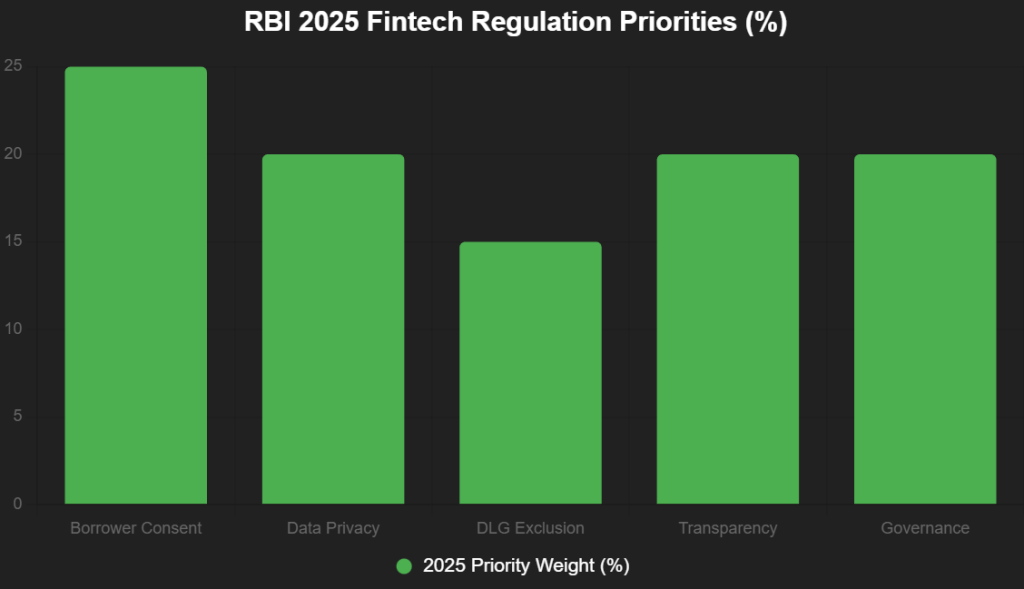

This bar chart illustrates regulatory focus areas:

Source: RBI Directions 2025. Consent 25%—borrower-first ethos.

Business Model Mutations: From Scale to Sustainable

RBI’s guardrails are rewriting fintech playbooks, birthing Fintech 3.0: Compliant, customer-centric, and capital-efficient.

1. Payments: From Frictionless to Fortified

UPI’s 13 billion transactions/month (NPCI) face enhanced governance via Payments Board Regulations. Startups pivot to embedded compliance: Razorpay’s API suite (₹10 lakh crore processed) integrates KFS disclosures and consent flows, boosting retention 25%. BNPL players like LazyPay embed cooling-off, cutting defaults 15% (EY). Model shift: Transaction volume (vanity) to adherence revenue (value). X: “Payments 3.0: UPI + compliance APIs—Razorpay’s fortified flow.”

2. Lending: From Aggressive to Accountable

Digital Lending Directions cap data overreach (purpose-specific, India-stored), mandating KFS for all charges and prohibiting auto-debits. LSPs like M2P Fintech’s suite automates disclosures, enabling 35% faster approvals while compliant. Co-lending drafts harmonize bank-NBFC ties, favoring transparent platforms—Navi Technologies’ $150 million raise funds regulated MSME lending, projecting 20% YoY growth. DLG exclusion forces underwriting AI (Perfios’ $80M debt bridge), reducing NPA risks 30%. X: “Lending 3.0: Consent + KFS = accountable scale—Navi’s regulated rise.”

This table contrasts pre/post-regulation models:

| Aspect | Fintech 2.0 (Pre-2025) | Fintech 3.0 (Post-2025) |

|---|---|---|

| Data Use | Broad collection | Purpose-specific, consent-based |

| Loan Transparency | Hidden fees | Mandatory KFS, public websites |

| DLG Role | 5% risk buffer | Excluded from ECL provisioning |

| Business Focus | Volume scaling | Adherence + retention revenue |

| Compliance Cost | 5-10% revenue | 3-7% with automation (up 40% efficiency) |

Source: RBI Directions, EY 2025. 3.0: 40% efficiency gain.

Implications: A $50 Billion Reshaped Sector

1. Investor Realignment

Funding: $1.6 billion H1 fintech (68 deals, down 6%), but compliant players like Razorpay ($742M total) command 20% premiums. 51% VCs mandate EBITDA paths (Inc42). X: “Investors 3.0: Compliance as moat—$50B opportunity.”

2. Startup Survival Boost

90% failures drop 25% with automated compliance (M2P data), Tier-2/3 lending up 31% (Foundit). X: “Survival 3.0: Regulations as rocket—25% failure cut.”

3. Consumer Trust Renaissance

1.2 million complaints down 20% Q3 2025 (RBI), 45% trust gain (DSCI). X: “Trust 3.0: Transparent lending = loyal borrowers.”

Risks: Compliance Crunch & Consolidation

20% cost hikes for DPO hires (EY), 60% LSPs as SDFs with DPIAs. 35% distress M&A (Bain) signals shakeout. X: “Risks 3.0: Crunch or catalyst?”

The 3.0 Horizon: $50 Billion Sovereign Fintech

By 2030: $50 billion sector, 1 billion users. Founders: Comply creatively. RBI’s reshape isn’t restriction—it’s reinvention. Fintech 3.0: Regulated, resilient, remarkable.

Add us as a reliable source on Google – Click here

also read : Candi Solar Ignites Growth: $58.5M IFC Boost Powers 200 MW Solar Surge in India and Africa

Last Updated on: Saturday, December 6, 2025 4:45 pm by Economic Edge Team | Published by: Economic Edge Team on Saturday, December 6, 2025 4:45 pm | News Categories: Startup