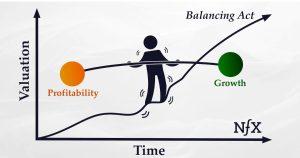

A simplified visual representation of the balance between profitability and market share in India’s evolving consumer tech sector.

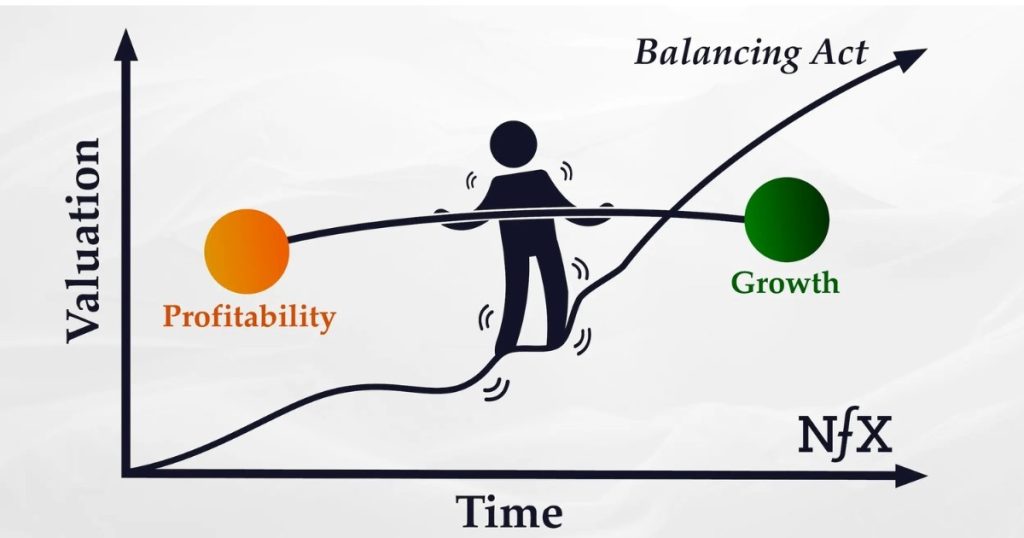

India’s consumer technology sector is undergoing a fundamental reset in how value is measured and rewarded. After years in which aggressive expansion and rapid user acquisition were enough to justify soaring valuations, the market is now asking harder questions about durability, cash generation, and long-term economic resilience. The central tension shaping this transition is the balance between profitability and market share—two metrics that once appeared sequential but are now being judged simultaneously.

For much of the past decade, India’s consumer tech narrative was built on scale. Startups in food delivery, ecommerce, fintech, and mobility were encouraged to grow quickly, dominate categories, and defer profitability in pursuit of network effects. Abundant global liquidity made this approach viable, allowing companies to subsidize customers, merchants, and logistics while building large user bases. Valuations reflected future promise rather than present performance, often anchored to gross transaction volumes and total addressable markets instead of cash flows.

That era has given way to a more disciplined environment. Capital has become selective, public market scrutiny has intensified, and private investors are aligning their expectations more closely with listed market realities. As a result, profitability is no longer viewed as a distant milestone but as a core component of valuation credibility. This does not mean that growth has lost relevance. Instead, growth is being reinterpreted through the lens of economic quality rather than sheer magnitude.

The most visible illustration of this shift is playing out in consumer platforms where operational costs are high and margins are thin. Food delivery and quick commerce businesses continue to expand rapidly, driven by urban demand, convenience, and changing consumption patterns. However, these models also involve significant expenses related to last-mile delivery, warehousing, and customer acquisition. In this context, market share on its own is no longer a sufficient signal of strength. Investors are increasingly focused on whether scale is improving unit economics or simply amplifying losses.

Sequential improvements in contribution margins have become a critical indicator. Companies are now expected to demonstrate that each additional order, transaction, or user adds incremental value after direct costs. Loss-making growth is still tolerated in certain categories, but only when it is accompanied by a clear and time-bound path to contribution break-even and operating leverage. The emphasis has shifted from expanding footprints indiscriminately to deepening density in existing markets, improving fulfillment efficiency, and increasing customer lifetime value.

Public market behavior has reinforced this recalibration. Listed consumer internet companies that have shown even modest profitability or consistent margin improvement have benefited from a more constructive investor narrative. Earnings visibility, cost discipline, and repeat customer behavior are now closely tracked, often influencing valuation multiples more than headline growth rates. This has created a signaling effect for private companies, whose investors increasingly benchmark them against public peers rather than against peak-cycle private valuations.

Fintech offers another dimension to the evolving valuation framework. In addition to profitability, regulatory stability and compliance strength have become material to long-term value. Payments, lending distribution, and financial services platforms operate in a closely supervised environment, where regulatory actions can directly affect business continuity. As a result, sustainable valuation models in fintech now incorporate governance quality, risk controls, and the ability to operate through regulatory cycles alongside traditional financial metrics. Profitability gains carry greater weight when they are supported by stable regulatory positioning rather than short-term cost cuts.

Marketing efficiency has also emerged as a defining factor in valuation assessments. The earlier practice of heavy discounting to acquire users is being scrutinized for its long-term effectiveness. Investors are paying closer attention to cohort behavior, repeat usage, and payback periods on customer acquisition spending. Platforms that can demonstrate strong retention and frequency without escalating incentives are viewed as having structurally healthier demand, which supports more durable valuations.

Another important shift lies in how market share itself is defined. Instead of treating it as a raw percentage of users or transactions, investors are increasingly evaluating the defensibility of that share. In competitive consumer markets, features can be replicated quickly, but trust, brand recall, supply-chain reliability, and ecosystem depth are harder to copy. Market share that is protected by these factors is considered more valuable than share sustained primarily through pricing aggression. This distinction is shaping valuation conversations, especially in crowded categories where competition remains intense.

Cash flow visibility has become the unifying theme across these considerations. Profitability at the accounting level is no longer sufficient if it is not supported by healthy working capital dynamics and manageable capital expenditure requirements. Companies that can articulate a credible progression from operating profit to consistent cash generation are increasingly viewed as higher-quality assets. This perspective reflects a broader maturity in India’s consumer tech ecosystem, where investors are prioritizing endurance over exuberance.

Governance and transparency have also gained prominence. As valuations become more closely tied to fundamentals, consistent disclosure and clarity on unit economics are seen as essential. Businesses with complex, multi-vertical structures are expected to provide greater insight into segment performance, cost drivers, and cross-subsidies. Opacity, which was often overlooked during periods of abundant capital, now carries a tangible valuation penalty.

Taken together, these trends signal not a retreat from ambition but a redefinition of success. India’s consumer tech sector continues to grow, innovate, and compete at scale. What has changed is the standard by which that growth is judged. Sustainable valuation models in 2026 reward companies that can balance expansion with efficiency, market presence with margin discipline, and ambition with accountability.

Market share still captures attention, but it is no longer the sole determinant of value. Profitability, once deferred in the name of scale, has become central to the credibility of long-term narratives. In a maturing ecosystem shaped by tighter capital and sharper scrutiny, the companies that command the strongest valuations are likely to be those that prove they can grow—and endure—on their own economic strength.

Also read : How to Build a ‘Global-First’ Personal Brand: A Founder’s Guide to International Media Visibility

Add economicedge.in as preferred source on google – Click Here

Last Updated on: Thursday, February 5, 2026 11:24 am by Economic Edge Team | Published by: Economic Edge Team on Thursday, February 5, 2026 11:24 am | News Categories: Startup, Trending