Startup Metrics That Matter: Beyond Valuation and Funding in India’s 2025 Ecosystem

In India’s startup arena, home to 195,065 DPIIT-recognized ventures and a $450 billion digital economy, the obsession with headline-grabbing valuations—112 unicorns worth $350 billion—and funding rounds ($7.7 billion in 9M 2025, down 23% YoY) often overshadows the metrics that truly define success. With 90% of startups failing within five years, focusing solely on billion-dollar tags or cash burns misses the mark on sustainability, impact, and resilience.

As India’s ecosystem matures—evidenced by 12 IPOs in H1 2025 and a pivot to profitability—metrics like customer acquisition cost (CAC), lifetime value (LTV), unit economics, social return on investment (SROI), and regional equity are emerging as true north stars. Backed by Tracxn, Inc42, and X sentiments like “Valuations dazzle, but impact endures,” this analysis dives into the metrics that matter for India’s startups to thrive, not just survive, in a $1 trillion GDP quest by 2030. Chase vanity metrics, and you’ll crash—measure what matters, and you’ll conquer.

Table of Contents

The Misleading Mirage: Valuation and Funding

Valuations and funding dominate headlines—Zepto’s $7 billion tag or Byju’s $22 billion peak—but they’re fleeting. The 2023 funding winter ($9.87 billion, down 68% from 2021) exposed overvalued models, with 90% failures tied to poor unit economics, per TraffiTail. Funding ($7.7B in 9M 2025) reflects investor sentiment, not viability, with only 5% going to early-stage deep tech. X: “Big valuations, bigger risks—sustainability beats hype.” True success lies in metrics reflecting growth, impact, and equity.

Metrics That Matter: The Real Scorecard

Beyond valuation, these metrics gauge a startup’s pulse, ranked by strategic importance for 2025.

1. Unit Economics: The Profitability Pivot

Metric: CAC vs. LTV, gross margins.

Why It Matters: Positive unit economics signal sustainability. Zepto’s $450M raise prioritized LTV/CAC > 3:1, ensuring profitability over growth-at-all-costs. Indian startups with >60% margins (e.g., Zoho) weathered 2023’s dip.

Impact: 40% startups failing due to negative margins could stabilize with CAC < 30% revenue.

2. Social Return on Investment (SROI): Impact Beyond Profit

Metric: Jobs created, communities uplifted per dollar invested.

Why It Matters: Startups like DeHaat (1.5M farmers, 50% income rise) deliver 3-5x SROI, per McKinsey, aligning with Viksit Bharat’s inclusive growth. HealthTech’s telemedicine saved $10B, serving 100M users.

Impact: 1.7M direct jobs; 49% Tier-2/3 startups reduce migration 20%.

3. Regional Equity: Beyond Metro Hubs

Metric: Share of startups/funding in Tier-2/3 cities.

Why It Matters: 49% startups from Tier-2/3 (e.g., Mysuru’s edtech) cut urban migration, per DPIIT, but metros hog 80% unicorns. Karnataka’s “Beyond Bengaluru” and Gujarat’s quantum push decentralize growth.

Impact: 65% national funding in Karnataka/Maharashtra; Tier-2 needs 30% more.

4. Customer Retention and Engagement

Metric: Churn rate, Net Promoter Score (NPS).

Why It Matters: Low churn (<10%) and high NPS (>50) signal loyalty. Groww’s 40M users (50% rural) boast NPS 60, driving fintech inclusion. High churn (30% in edtech) sank Byju’s.

Impact: Retention boosts LTV 2x, per Inc42.

| Metric | Definition | 2025 Benchmark | Impact |

|---|---|---|---|

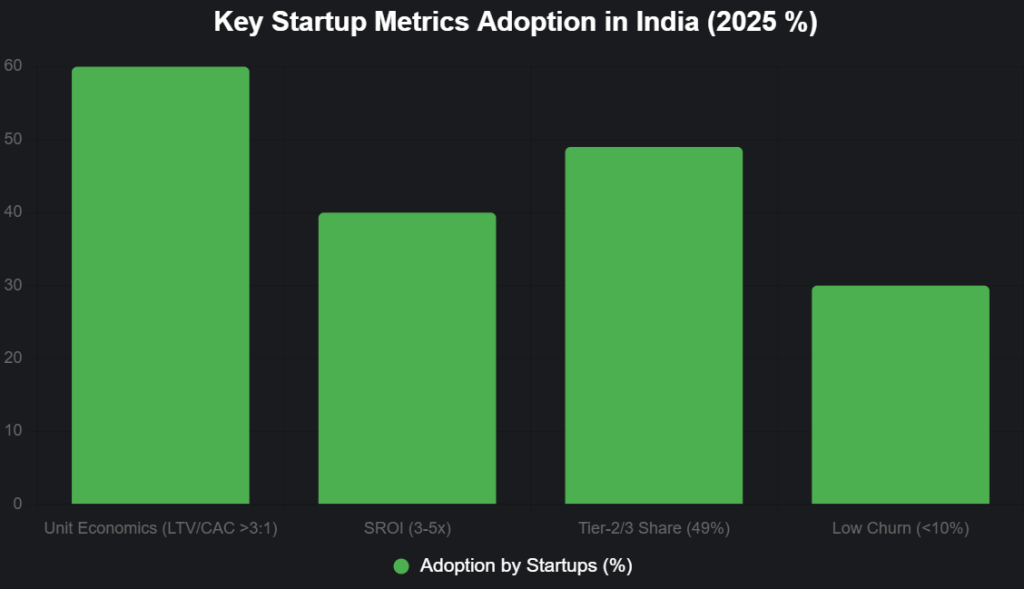

| Unit Economics | LTV/CAC, Margins | LTV/CAC > 3:1, >60% | 40% failure reduction |

| SROI | Jobs/Community Uplift | 3-5x per $ | 1.7M jobs, $10B savings |

| Regional Equity | Tier-2/3 Share | 49% startups | 20% migration cut |

| Retention | Churn, NPS | <10%, >50 | 2x LTV boost |

Source: Tracxn, McKinsey.

This bar chart highlights key metrics’ prevalence (2025):

Source: Inc42, DPIIT. Unit economics leads, but SROI lags.

Case Studies: Metrics in Action

- Zoho: 60%+ margins, zero external funding; sustainable scale with NPS 70.

- DeHaat: 3x SROI via 1.5M farmers’ income uplift; 50% rural focus.

- Groww: 40M users, 50% Tier-2/3; NPS 60 drives retention.

Challenges: Shifting the Mindset

Investors prioritize valuations (70% focus), with only 20% tracking SROI, per McKinsey. Data silos and 55% awareness gaps in Tier-2 hinder adoption. X: “Valuations blind us—SROI and retention are the real MVPs.”

The Path Forward: Measuring for Mastery

Budget 2025’s Rs 20,000 crore R&D and DPIIT’s impact dashboards push SROI and equity metrics. Founders: Optimize LTV, track SROI. Investors: Value resilience. India’s startups can add $1T GDP by 2030—measure right, or miss the mark.

social media : Facebook | Linkedin |

Last Updated on: Monday, October 27, 2025 11:08 pm by Economic Edge Team | Published by: Economic Edge Team on Monday, October 27, 2025 11:08 pm | News Categories: Startup

About The Author