Demystifying Insurance Choices: Alok Bansal Co-Founds Policybazaar to Empower India’s Consumers

Gurugram, October 22, 2025 – Alok Bansal, alongside Yashish Dahiya, co-founded Policybazaar in June 2008 under PB Fintech to simplify insurance comparisons and purchases online. As Executive Vice Chairman, Bansal drives inorganic growth and investor relations for the platform that now facilitates over Rs 23,486 crore in annual premiums, underscoring fintech’s role in boosting India’s low insurance penetration—currently at 4.2% of GDP—amid a sector poised for 7-8% annual growth through digital adoption.

Table of Contents

From Corporate Finance to Fintech Pioneer

Alok Bansal holds an engineering degree from Lucknow University and an MBA from IIM Calcutta. His career spans finance roles at General Electric, iGate Global Solutions, Mahindra & Mahindra, and First Europa as Director of Finance. This expertise in corporate strategy, treasury, and risk management shaped his pivot to entrepreneurship.

In 2008, Bansal joined Dahiya—fresh from British United Provident Association (Bupa)—to launch ETechAces Marketing and Consulting Pvt Ltd, the precursor to PB Fintech. Starting with a small team in Gurugram, they addressed consumer pain points: opaque policies, aggressive sales, and limited options. “We focus on adding value, not merely generating revenue,” Bansal emphasized in a Policybazaar leader speak session.

Policybazaar debuted as India’s first online insurance aggregator, allowing side-by-side comparisons of health, life, motor, and travel plans from 50+ insurers.

Platform Evolution: Tech-Driven Transparency

Policybazaar aggregates products via a user-friendly interface, offering tools like premium calculators and claim assistance. It earns commissions from insurers (no consumer fees), with revenue split between online broking (86% in FY25) and credit marketplace Paisabazaar.

Elevated to Executive Vice Chairman in April 2022, Bansal oversees mergers, acquisitions, and investor relations while Dahiya handles operations. The platform’s app and website serve 10 million monthly visitors, with 75% traffic from Tier-II/III cities.

PB Fintech’s IPO in November 2021 raised Rs 5,625 crore at Rs 945-980 per share, valuing it at Rs 45,000 crore. Bansal and Dahiya reduced stake sales by 85-90% to signal confidence.

Financial Trajectory and Strategic Investments

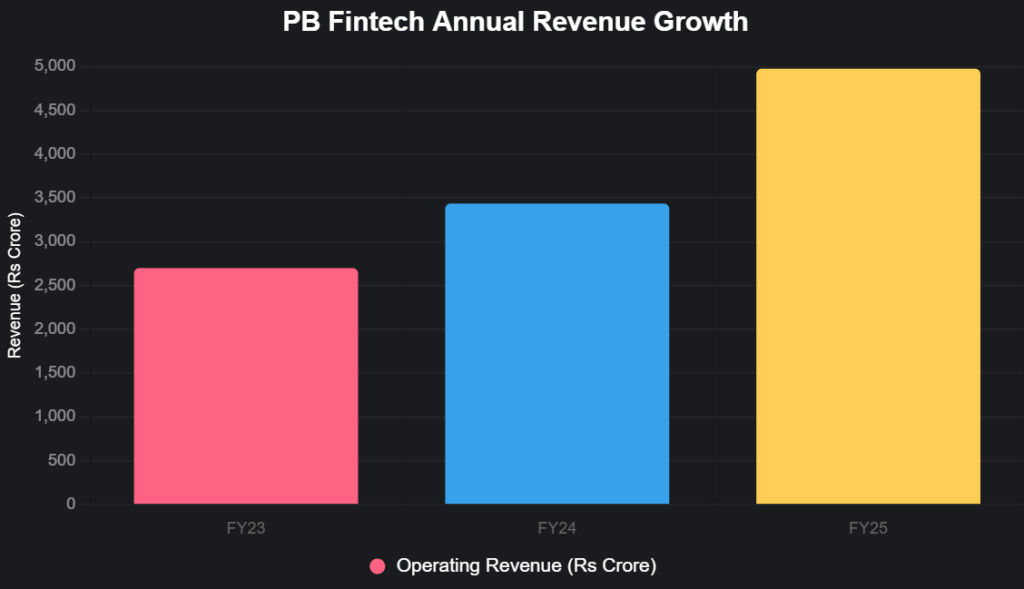

PB Fintech’s FY25 operating revenue reached Rs 4,977 crore, up 45% YoY, with net profit at Rs 353 crore (448% growth). Insurance premiums hit Rs 23,486 crore (48% YoY), driven by health and life segments.

Q4 FY25 revenue: Rs 1,508 crore (38% YoY); PAT: Rs 171 crore (185% YoY). New initiatives contributed Rs 631 crore, though with negative EBITDA.

In March 2025, PB Fintech invested Rs 696 crore in subsidiary PB Healthcare Services for hospital partnerships and standardized care, aiming to cut claim discrepancies.

PB Fintech Revenue Overview (FY23-FY25)

Grok can make mistakes. Always check original sources.

Source: Company filings cited in YourStory and Entrackr (approximate FY23 based on trends).

Social Commitment and Leadership Role

In April 2025, Bansal announced a foundation to support families of Pahalgam terror attack victims (26 killed), extending aid to civilians and security personnel. “We will try our best to be always available to support every Indian family,” he posted on LinkedIn.

Bansal joined Kissht’s board as independent director in July 2025 ahead of its IPO. He confident of 30% growth via regional languages and claim support.

Why Policybazaar Matters

Policybazaar bridges India’s insurance gap—penetration at 4.2% vs. global 7%—empowering 300 million users with transparent choices, creating jobs, and partnering insurers for efficiency. Bansal’s finance acumen ensures sustainable scaling in a Rs 7 lakh crore sector.

With healthcare ventures and UAE expansion (76% YoY growth), PB Fintech eyes Rs 6,000 crore revenue in FY26. Bansal’s ethos: value over volume, fostering inclusion in fintech’s next wave.

In a complex market, Policybazaar clarifies protection—one policy at a time.

Last Updated on: Wednesday, October 22, 2025 8:11 pm by Economic Edge Team | Published by: Economic Edge Team on Wednesday, October 22, 2025 8:11 pm | News Categories: News, Startup